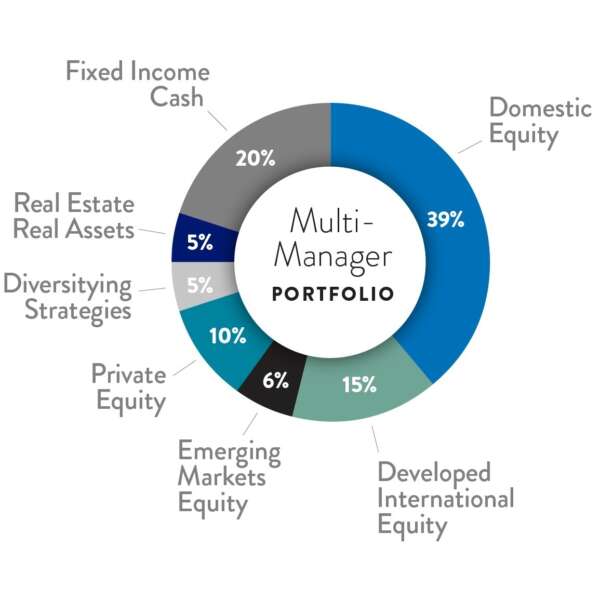

Multi-Manager Portfolio

CFWNC’s largest and most fully-diversified portfolio utilizes multiple asset classes in pursuit of the return objective of CPI+4.5% annualized return over a full market cycle. More than 30 individual managers manage investment strategies through a combination of mutual funds, separately managed accounts and institutional investment offerings. The portfolio utilizes traditional asset classes such as global equity and fixed income as well as complementary strategies such as diversifying hedged strategies and real assets. The portfolio is designed to participate in bull markets while also providing downside protection during market downturns.